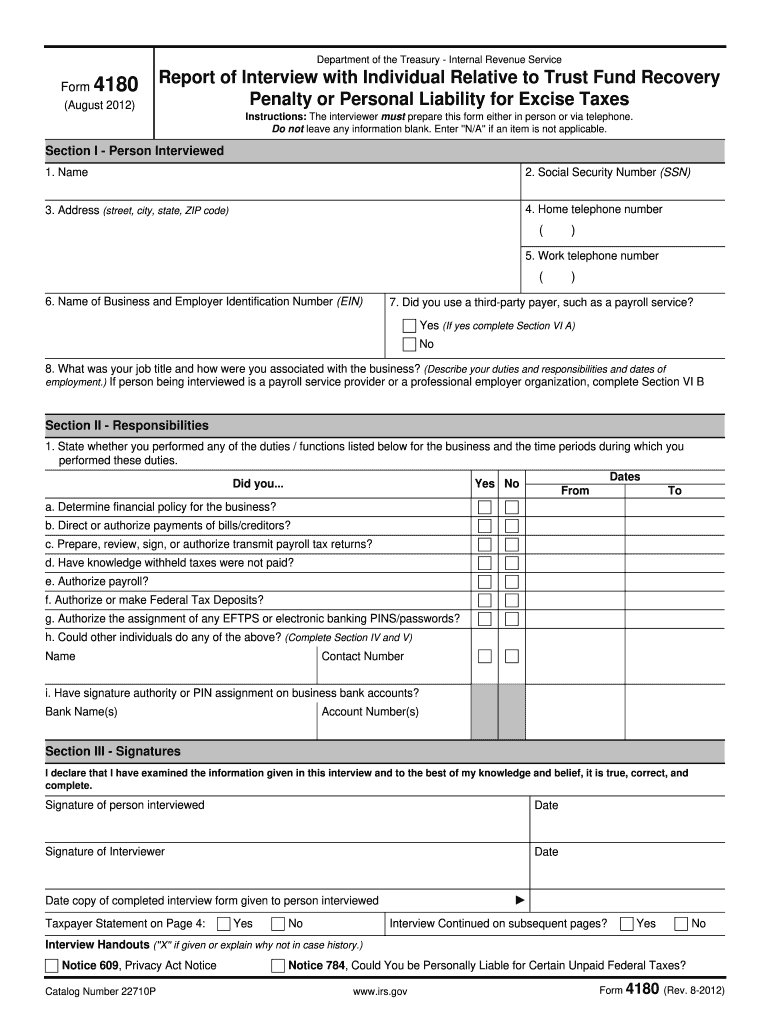

IRS 4180 2012-2026 free printable template

Instructions and Help about IRS 4180

How to edit IRS 4180

How to fill out IRS 4180

Latest updates to IRS 4180

All You Need to Know About IRS 4180

What is IRS 4180?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 4180

What should I do if I need to correct a mistake on my IRS 4180?

If you need to correct a mistake after filing the IRS 4180, you should file an amended form. Ensure you clearly indicate the corrections and provide additional documentation if necessary. It's important to track the status of your amended submission to ensure it is processed correctly.

How can I verify if my IRS 4180 has been received and processed?

To verify the receipt and processing status of your IRS 4180, you can use the IRS e-file status tool. This tool allows you to check the current status of your submission, and it may also provide information on any common rejection codes and what actions to take if your submission was rejected.

Are there any specific legal considerations when filing IRS 4180 for foreign payees?

When filing IRS 4180 for foreign payees, you must understand the tax treaty agreements and any applicable withholding rates. It's crucial to ensure compliance with IRS regulations regarding foreign entities to avoid potential penalties.

What should I do if I receive a notice or audit after submitting my IRS 4180?

If you receive a notice or are subject to an audit after submitting your IRS 4180, it's essential to review the notice carefully and gather all relevant documentation you submitted. Consult with a tax professional to prepare your response and ensure you address the IRS's concerns effectively.

How can I avoid common errors when filing my IRS 4180?

To avoid common errors when filing your IRS 4180, double-check all information for accuracy and completeness before submission. Ensure that you are using the correct form version and that all necessary signatures are included. Familiarizing yourself with prevalent pitfalls, such as missing tax identification numbers, can also help reduce mistakes.

See what our users say