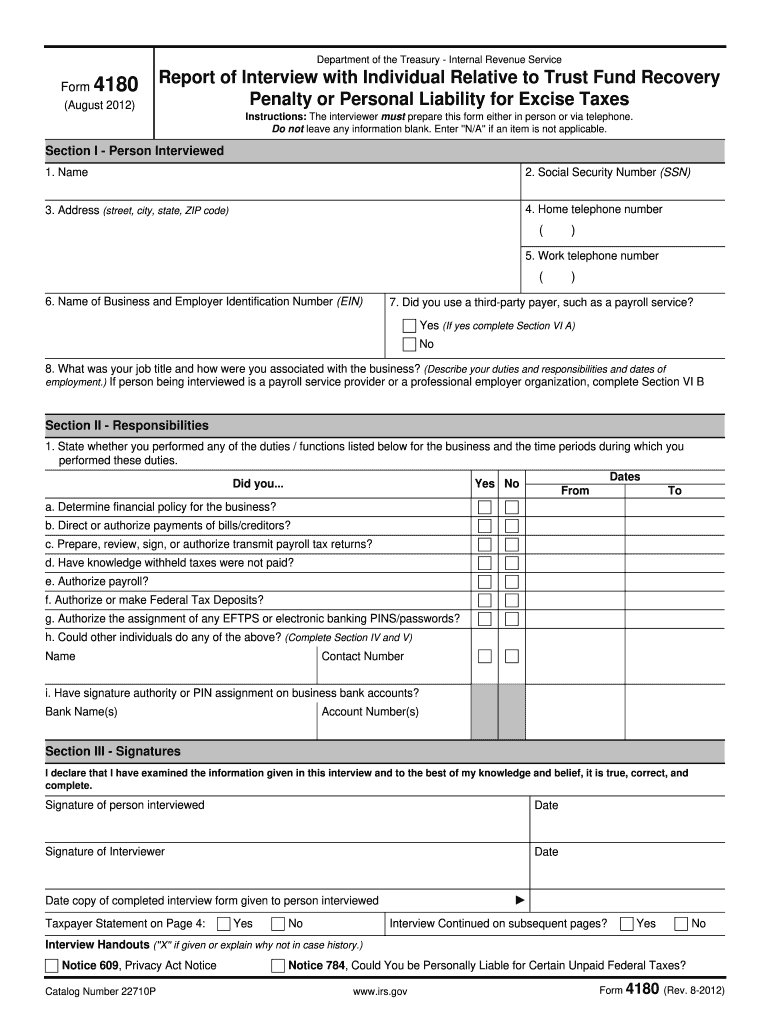

Who needs form 4180?

Form 4180 is an interview report filed out by an IRS officer who has held an interview.

What is form 4180 for?

When economic situation isn't favorable, many businesses decide to use payroll tax money to stay afloat. But more often than not they get into troubles when not paying this money back to the IRS. In this case, the IRS starts its investigation to find people responsible for tax withholding. Form 4180 serves to record the interview which is a part of this investigation.

Is form 4180 accompanied by other forms?

As a rule, form 4180 does not include any attachments. However, there is a separate page designed for additional information.

When is form 4180 due?

Form 4180 has no deadline. It is being completed while the IRS conducts its Trust Fund Investigation.

How do I fill out form 4180?

The form itself is a list of questions to be answered by the interviewed person. In total, there are four fillable pages and seven sections. In the first section an interviewer reports identity information of the person being interviewed. Section 2 is to record the responsibilities an interviewed person carries out in a company. Section 3 provides interviewer's and interviewee's signatures. Section 4 contains business information while section 5 reports individual's knowledge about the company's financial obligations. Not only interviewer but also an interviewee may look through the questions before the interview.

Where do I send form 4180?

Initially, form 4180 serves to provide the IRS with details of the investigation for the IRS to define the penalty. Thus, form 4180 is sent to the IRS once it is completed.